-

Tracking cycle

-

Getting pregnant

-

Pregnancy

-

Help Center

-

Flo for Partners

-

Anonymous Mode

-

Flo app reviews

-

Flo Premium New

-

Secret Chats New

-

Symptom Checker New

-

Your cycle

-

Health 360°

-

Getting pregnant

-

Pregnancy

-

Being a mom

-

LGBTQ+

-

Quizzes

-

Ovulation calculator

-

hCG calculator

-

Pregnancy test calculator

-

Menstrual cycle calculator

-

Period calculator

-

Implantation calculator

-

Pregnancy weeks to months calculator

-

Pregnancy due date calculator

-

IVF and FET due date calculator

-

Due date calculator by ultrasound

-

Medical Affairs

-

Science & Research

-

Pass It On Project New

-

Privacy Portal

-

Press Center

-

Flo Accuracy

-

Careers

-

Contact Us

Build the future of women’s health

Working at Flo

Work on a unique product

Here at Flo we create a unique platform for women to monitor their health using AI and cutting-edge data analytics to provide unparalleled experience for our users.

Work with top talent

At Flo we expect every new hire to raise the bar. By exceeding our own expectations, we ensure that we always work with the top professionals in every field.

Grow together

Growth at Flo means constantly finding ways to challenge your thinking and expand your skills. The more you do, the more you learn, the greater your impact will be on the company goals.

Achieve more

We practice “servant leadership.” Managers at Flo ask “What can I do for you?” rather than vice versa. They support their teams to better growth and through continuous improvement.

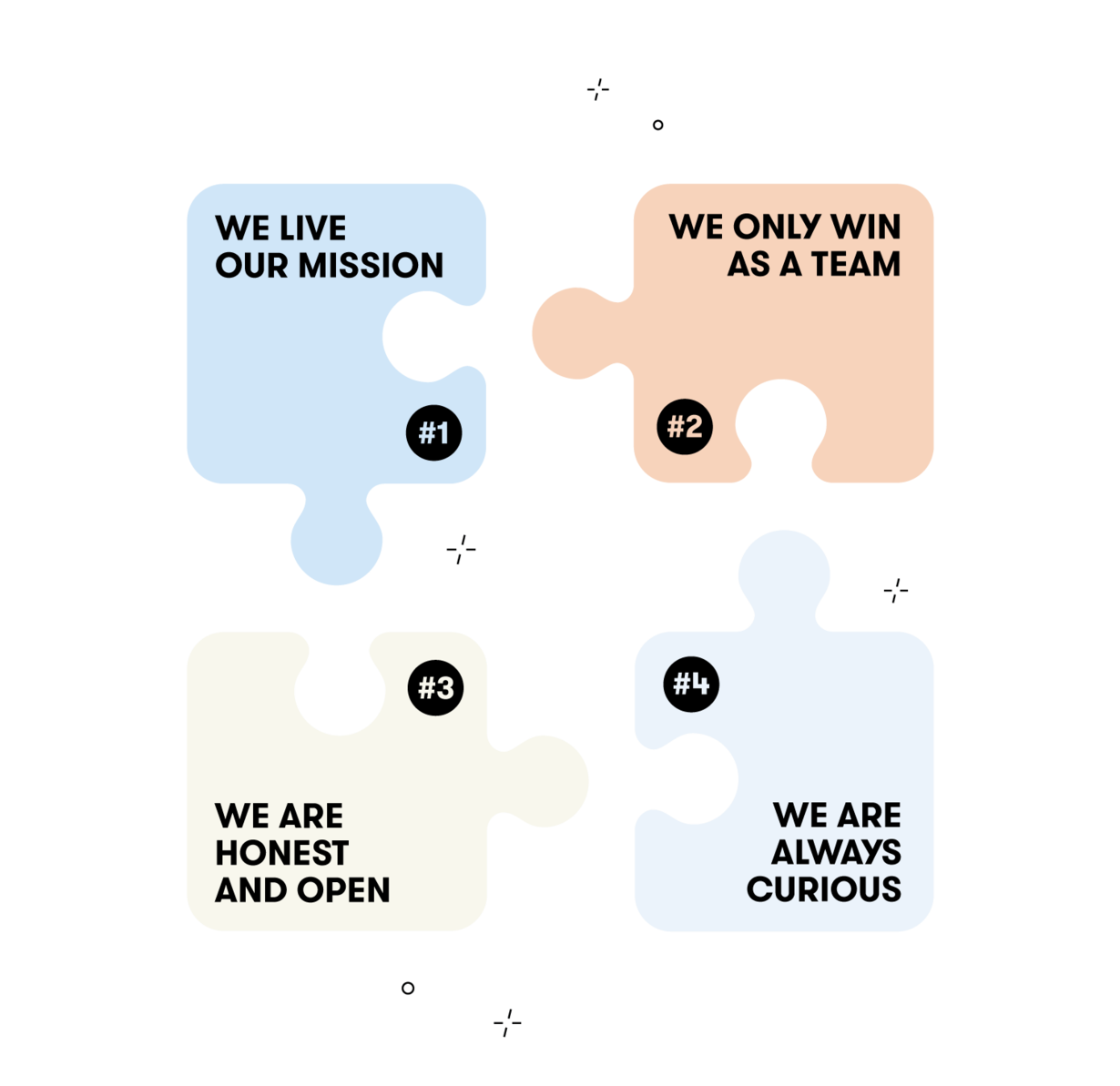

Flo Cultural Values

Over the course of all these years, we’ve formalized our underlying principles, what we can and can’t compromise on, how we actually set goals, make decisions, resolve disagreements, build priorities, treat each other, and define impact.

Global benefits

Participation in Flo’s success

We firmly believe every employee contributes to the company’s growth and its future success. All employees are eligible to participate in Flo’s Employee Share Ownership Plan (ESOP) and be awarded equity to participate in the long-term value creation of the business.

Family benefits

We know having a baby can be a big transition for the family, so we're proud to offer 1 month fully paid paternity leave to be there and bond with your baby and 6 months of fully paid maternity leave, with a $5000 bonus on your return to work to help you settle into this new chapter of your life

Resources you need to thrive

At Flo you will have access to internal and external learning resources and tools to challenge your knowledge and push yourself further every day. We support career progression from within through personal development plans and dedicated Learning & Development budget to help you thrive.

Holiday and sick leave

It’s important to take time off to recharge and spend time with family and friends. We offer 25 days (28 for vice presidents and above) paid holiday in addition to the local public holidays and 30 days fully paid sick leave per year.

Flexible workplace

We want to provide a setup that gives our employees the flexibility they need, while also getting important face to face time with the team. With this in mind, we encourage teams to spend 2 days/week in the office.

Our popular Workation policy also allows you to work from anywhere for up to 2 months a year.

How we create Flo

Technology behind Flo

Hiring in London and Vilnius

The work we do at Flo makes us proud, both as teammates and as parents, partners, and spouses.